Protect Yourself From The Unexpected

Buying a car is one of the biggest purchases you’ll make in your life, and it’s important to protect that purchase. Insurance is obviously important, but there are additional ways to further protect your vehicle. We offer both Depreciation Protection Waiver (DPW) and Guaranteed Asset Protection (GAP) insurance. Contact or visit us to learn more or sign up for one of these protection plans.

Depreciation Protection Waiver (DPW)

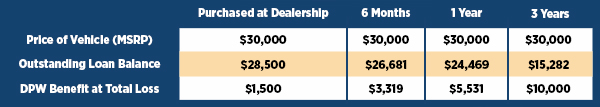

Depreciation Protection Waiver (DPW) protects your vehicle equity and hedges against depreciation over the life of the loan. In the event of a total loss, DPW provides a benefit equal to the difference between your vehicle's Manufacturer Suggested Retail Price (MSRP) or J.D. Power retail value at the time of coverage enrollment, minus the amount of your loan balance at the time of total loss up to a maximum waiver benefit of $10,000, or the outstanding loan balance. DPW kicks in if your vehicle is ever totaled in a collision or stolen and not recovered at any time over the life of the loan.

Benefits of Depreciation Protection Waiver (DPW)

- Protection for vehicle depreciation

- Protection for collision or comprehensive total loss, including fire damage and theft

- Life of loan protection

- No mileage, make, or year restrictions

- Open enrollment

- 100% refundable for first 60-days

Depreciation Protection Waiver (DPW) is for you if you

- Finance 90% loan-to-value or less

- Put money down

- Trade-in a vehicle

- Make accelerated loan payments

- Need to protect equity

How DPW Works

Guaranteed Asset Protection (GAP)

In the event the insurance company deems the vehicle a total loss, GAP covers the difference between the loan balance and the value received by the insurance company. As a value-added benefit (ADR) Auto Deductible Reimbursement will refund the deductible up to $500 per loss, unlimited amount of time per year for the next 3 years on passenger vehicles own and insure.

Benefits of Guaranteed Asset Protection (GAP)

- 60 day refundable "free look" period

- May help you avoid financial hardship and afford a replacement vehicle

- No model, mileage or year restrictions

- May prevent a deficiency balance from being added to new loan

- May help protect your credit rating

- $1,000 towards the financing of a replacement vehicle

Auto Deductible Reimbursement (ADR)

Auto Deductible Reimbursement is included with Guaranteed Asset Protection (GAP) and Depreciation Protection Waiver (DPW). ADR reimburses up to $500 of your auto deductible if you make an insurance claim.

- By purchasing Guaranteed Asset Protection (GAP) and Depreciation Protection Waiver (DPW), you automatically receive three years of ADR.

- ADR pays up to $500 per claim, with unlimited claims for three years.

Mechanical Breakdown Protection (MBP)

Mechanical Breakdown Protection also known as a Vehicle Service Contract or MBP, is automobile protection that extends beyond the manufacturer's factory warranty and covers repairs of unexpected mechanical or electrical failures. For the period of time the contract is in effect, you are assured that covered components of your vehicle will be repaired in the event of a failure, including labor, subject to any applicable deductible. You will also have additional benefits such as 24/7 roadside assistance and rental vehicle reimbursement.

Why do you need MBP?

Did you know that one in three vehicles experiences a mechanical failure in a given year? The typical warranty owner will make several claims during the life of their agreement. Should your vehicle experience a failure after the manufacturer's warranty expires, without MBP you will have no protection from the unexpected repair costs that can be in the thousands of dollars!

Vehicles today are growing extremely complex and contain high-tech sensors, electronics and computers that frequently suffer unexpected failure and need to be replaced. While engines and transmissions are more reliable than ever, it's these other sophisticated parts that frequently fail. As vehicles become increasingly more complex, associated repair costs rise dramatically!

Features & Benefits of Mechanical Breakdown Protection (MBP)

- $0 Deductible

- Nationwide Coverage

- 24 Hours a Day/365 Days a year Emergency Roadside Service

- Trip Interruption

- Towing and Rental Car Allowance

- Battery Assistance

- Flat Tire Assistance

- Simple Claims Procedure

- Enhanced Electronics Package automatically included with Easy Street

- 30 Day Free Look Period

Debt Protection

Debt protection will cancel or suspend all or part of the obligation to repay a loan due to specified events, such as death, disability, and involuntary unemployment. Debt protection insurance is designed to help by providing financial support in times of need. Whether it’s due to unemployment, sickness, or disability, debt protection insurance can protect the insured from defaulting on their loans.

Submit A Claim

To submit a Guaranteed Asset Protection claim, call us at 800-341-9911.

To submit an Auto Deductible Reimbursement claim, contact an Allied claims administrator. You can call 877-296-4892 or visit assuranceplus.com/claims. You’ll need a copy of your insurance policy, and a receipt for a paid deductible.

To submit a payment protection claim, call us at 800-341-9911